VTshredder69

Active member

14478103:PacificRimJob said:It's really not in the shitter... I mean, it's not really benefiting people the lower and middle class, but that's been the case for a long-long time. It's simply "meh" if you're an investor right now - which you probably aren't. Meanwhile I receive about 6 or 7 messages per day on Indeed or Linkedin or other recruiter sites just begging me to take an interview. I'm sure that's the case for a LOT of people. That's not a sign of a shitty economy.

The unemployment rate is at 3.5%.. right back to where it was in Feb 2020 when Covid fucked us, and consumers are still buying stuff to the point where the Fed is like 'wtf, chill out, we gotta ease this shit - can we raise interest rates? JFC!'

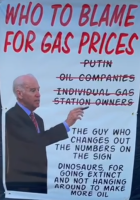

Yeah, gas prices are higher than usual and inflation is at a 40-year high, but that's not a domestic issue - it's a global one - and the USA has been much more resilient in both cases than other comparable economies. It will take time, but things will mellow out and we might already be on the plateau. There will be a regression to the mean, here.

Don't get me wrong, inflation is scary, especially when you see prices on consumer goods jump by quite a bit compared to 3 years ago - but this is nothing like the housing crisis when everyone was losing their house left and right, and jobs dried up. Back then, unemployment went from 5% to 10% in 18 months... Instead, It's at 3.5% and there are still hiring signs left right and centre and everywhere seems understaffed.

I don't call a recession "meh".

I know the biden admin refuses to admit it's a recession, but the term has always been defined as two consecutive quarters of a negative gdp growth.

Interpret as you like.