ThiTaxation is a fundamentally immoral and very flawed policy.

Here are some things to think about: The following is from Wikipedia:

"Tariffs were the largest source of federal revenue from the 1790s to the eve of

World War I"

Income tax

See also: Income tax in the United States#Legal history

The history of income taxation in the United States began in the

19th century with the imposition of income taxes to fund war efforts.

However, the constitutionality of income taxation was widely held in

doubt until 1913 with the ratification of the

16th Amendment.

[

edit] Legal foundations

Article I, Section 8, Clause 1 of the United States Constitution assigns

Congress

the power to impose "Taxes, Duties, Imposts and Excises," but Article

I, Section 8 requires that, "Duties, Imposts and Excises shall be

uniform throughout the United States."

[12]

In addition, the Constitution specifically limited Congress' ability

to impose direct taxes, by requiring it to distribute direct taxes in

proportion to each state's census population. It was thought that

head taxes and

property taxes

(slaves could be taxed as either or both) were likely to be abused, and

that they bore no relation to the activities in which the federal

government had a legitimate interest. The fourth clause of section 9

therefore specifies that, "No Capitation, or other direct, Tax shall be

laid, unless in Proportion to the Census or enumeration herein before

directed to be taken."

Taxation was also the subject of

Federalist No. 33 penned secretly by the Federalist

Alexander Hamilton under the

pseudonym Publius.

In it, he explains that the wording of the "Necessary and Proper"

clause should serve as guidelines for the legislation of laws regarding

taxation. The legislative branch is to be the judge, but any abuse of

those powers of judging can be overturned by the people, whether as

states or as a larger group.

The courts have generally held that direct taxes are limited to

taxes on people (variously called "capitation", "poll tax" or "head

tax") and property

[13]. All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property

per se.[14]

What seemed to be a straightforward limitation on the power of the

legislature based on the subject of the tax proved inexact and unclear

when applied to an income tax, which can be arguably viewed either as a

direct or an indirect tax.

[

edit] Pre-16th Amendment

In order to help pay for its war effort in the

American Civil War, the

United States government imposed its first personal income tax, on

August 5,

1861, as part of the

Revenue Act of 1861 (3% of all incomes over US $800; rescinded in 1872). Congress also enacted the

Revenue Act of 1862,

which levied a 3% tax on incomes above $600, rising to 5% for incomes

above $10,000. Rates were raised in 1864. This income tax was repealed

in 1872, but a new income tax statute was enacted as part of the 1894

Tariff Act.

[15]

At that time, the

United States Constitution

specified that Congress could impose a "direct" tax only if the law

apportioned that tax among the states according to each state's

census population.

[16]

In 1895, the

United States Supreme Court ruled, in

Pollock v. Farmers' Loan & Trust Co., that taxes on

rents from real estate, on

interest income from personal property and other income from personal property (which includes

dividend

income) were direct taxes on property and therefore had to be

apportioned. Since apportionment of income taxes is impractical, the

Pollock

rulings had the effect of prohibiting a federal tax on income from

property. Due to the political difficulties of taxing individual wages

without taxing income from property, a federal income tax was

impractical from the time of the

Pollock decision until the time of ratification of the Sixteenth Amendment (below).

[

edit] 16th Amendment

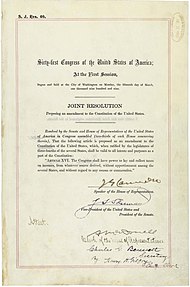

Amendment XVI in the

National Archives

Main article: Sixteenth Amendment to the United States Constitution

In response to the Supreme Court decision in the

Pollock case, Congress proposed the

Sixteenth Amendment, which was ratified in 1913,

[17] and which states:

The Congress shall have power to lay and collect taxes on incomes,

from whatever source derived, without apportionment among the several

States, and without regard to any census or enumeration.

The

Supreme Court in

Brushaber v. Union Pacific Railroad, 240 U.S. 1 (1916),

indicated that the Sixteenth Amendment did not expand the federal

government's existing power to tax income (meaning profit or gain from

any source) but rather removed the possibility of classifying an income

tax as a direct tax on the basis of the source of the income. The

Amendment removed the need for the income tax on interest, dividends

and rents to be apportioned among the states on the basis of

population. Income taxes are required, however, to abide by the law of

geographical uniformity.

A comedic representation by

Clifford K. Berryman of the debate to introduce a sales tax in the United States in 1933 and end the income tax

Congress enacted an income tax in October 1913 as part of the

Revenue Act of 1913,

levying a 1% tax on net personal incomes above $3,000, with a 6% surtax

on incomes above $500,000. By 1918, the top rate of the income tax was

increased to 77% (on income over $1,000,000) to finance

World War I.

The top marginal tax rate was reduced to 58% in 1922, to 25% in 1925

and finally to 24% in 1929. In 1932 the top marginal tax rate was

increased to 63% during the

Great Depression

and steadily increased, reaching 94% (on all income over $200,000) in

1945. Top marginal tax rates stayed near or above 90% until 1964 when

the top marginal tax rate was lowered to 70%. The top marginal tax rate

was lowered to 50% in 1982 and eventually to 28% in 1988. During World

War II, Congress introduced payroll withholding and quarterly tax

payments.

[

edit] Development of the modern income tax

At first the income tax was incrementally expanded by the

Congress of the United States.

Inflation automatically raised many persons into tax brackets formerly

reserved for the wealthy until Congress began adjusting the income tax

brackets for inflation. Income tax now applies to almost ⅔ of the

population

[1].

The lowest earning workers, especially those with dependents, pay no

income taxes as a group and actually get a small subsidy from the

federal government because of child credits and the

Earned Income Tax Credit.

The federal government is now financed primarily by personal and corporate

income taxes. While the government was originally funded via

tariffs

upon imported goods, tariffs now represent only a minor portion of

federal revenues. Non-tax fees are generated to recompense agencies for

services or to fill specific

trust funds such as the fee placed upon

airline tickets for airport expansion and

air traffic control. Often the receipts intended to be placed in "trust" funds are used for other purposes, with the government posting an

IOU ('I owe you') in the form of a

federal bond or other

accounting instrument, then spending the money on unrelated current expenditures.

Net long-term

capital gains as well as certain types of qualified

dividend income are taxed preferentially. The federal government collects several specific taxes in addition to the general income tax.

Social Security and

Medicare are large

social support programs which are funded by taxes on personal earned income (see below).

[

edit] Treatment of "income"

Tax statutes passed after the ratification of the Sixteenth

Amendment in 1913 are sometimes referred to as the "modern" tax

statutes. Hundreds of Congressional acts have been passed since 1913,

as well as several codifications (i.e., topical reorganizations) of the

statutes (see

Codification).

The modern interpretation of the Sixteenth Amendment taxation power can be found in

Commissioner v. Glenshaw Glass Co. 348 U.S. 426 (1955).

In that case, a taxpayer had received an award of punitive damages from

a competitor, and sought to avoid paying taxes on that award. The Court

observed that Congress, in imposing the income tax, had defined income

to include:

gains, profits, and income derived from salaries, wages, or

compensation for personal service . . . of whatever kind and in

whatever form paid, or from professions, vocations, trades, businesses,

commerce, or sales, or dealings in property, whether real or personal,

growing out of the ownership or use of or interest in such property;

also from interest, rent, dividends, securities, or the transaction of

any business carried on for gain or profit, or gains or profits and

income derived from any source whatever.

[18]

The Court held that "this language was used by Congress to exert in

this field the full measure of its taxing power", id., and that "the

Court has given a liberal construction to this broad phraseology in

recognition of the intention of Congress to tax all gains except those

specifically exempted."

[19]

The Court then enunciated what is now understood by Congress and the

Courts to be the definition of taxable income, "instances of undeniable

accessions to wealth, clearly realized, and over which the taxpayers

have complete dominion." Id. at 431. The defendant in that case

suggested that a 1954 rewording of the tax code had limited the income

that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect

upon its present broad scope was intended. Certainly punitive damages

cannot reasonably be classified as gifts, nor do they come under any

other exemption provision in the Code. We would do violence to the

plain meaning of the statute and restrict a clear legislative attempt

to bring the taxing power to bear upon all receipts constitutionally

taxable were we to say that the payments in question here are not gross

income.

[20]

In

Conner v. United States[21],

a couple had lost their home to a fire, and had received compensation

for their loss from the insurance company, partly in the form of hotel

costs reimbursed. The court acknowledged the authority of the IRS to

assess taxes on all forms of payment, but did not permit taxation on

the compensation provided by the insurance company, because unlike a

wage or a sale of goods at a profit, this was not a gain. As the court

noted, "Congress has taxed income, not compensation".

[22]

By contrast, at least two other Federal courts have indicated that

Congress may constitutionally tax an item as "income," regardless of

whether that item is in fact income. See

Penn Mutual Indemnity Co. v. Commissioner[23] and

Murphy v. Internal Revenue Serv.[24]