CaptainObvious.

Active member

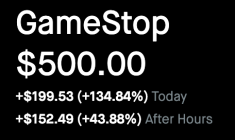

14233999:TOAST. said:Can someone explain to me the end game of the GME and other various stocks? Sure right now everyone that was shorting when it was on the decline are getting fucked, but it's not like the stock can go up forever and will eventually have a devastating crash back down?

The end goal from what I understand is to try and devastate large short positions coming to maturity soon. So if the stock price hits a peak when the hedge funds large positions mature, they get fucked. The huge issue with this is that there are ways to negotiate, change, extend, etc. so you’re right. Droves of amateurs are dumping money to create an artificially inflated stock price. They’re creating a bubble. The small percentage of smart investors who know this will sell at the right time and make their money on the backs of thousands of others who will lose their money.