14238862:DayMan said:

Love that I bought at the peak of both GME and AMC

Can't lose until you sell and I'M NOT SELLING DAMMIT

Just happy I didn't buy more because I definitely thought about it lol

Sooo who's got some sick stock picks with actual good value and fundamentals for me to recoup my GME/AMC losses

14239027:Rotten_Trumpkins said:

Ouch. I've been piling into the electric vehicle market recently for the long term. I got rid of my nvdia and amd after big gains but they probably are solid long term prospects.

If you do research, you can do pretty well with the covid plays. Biotech small cap stocks have high volatility though and high risk.

Well apparently I can't edit posts anymore when I put in an edit a few hours ago.

You were asking for specific picks. Honestly it depends on your risk profile and financial situation. I've had success with various biotech stocks on the past few years and lost on a few. The key is to buy when the sentiment is low but while having high confidence in their ability to perform in clinical trials and/or sales. This requires some reading.

NVAX might have room to run when nanoflu gets approved and if/when their covid vaccine gets EMA and FDA approval. Idk if I would buy now personally but I hold shares from 2016.

Germ ETF has been good to me.

Ocugen definitely has room to run. Their market cap is tiny and potential is good if their covid vaccine is successful. Preliminary data looks good and it already has EUA in India. Definitely pump and dump folks involved. If it fails in trials, this is going to

zero. If it's successful it's gonna have great returns. Because of the extreme risk, I'm covering my costs and holding the rest through data.

Trevena is one I'm long on. They're rolling out a new opioid for surgery and are due to release data for a covid therapy this quarter. Their market cap is small for the share their opiate can capture so I'm positive on this stock. Their pipeline is promising but definitely long term. If their covid therapy fails I'd expect it to drop by >25-50% and slowly gain back over months. If it's positive, then holy cow look out. Holding through data however since my average is very low and I've already sold enough shares to cover my cost.

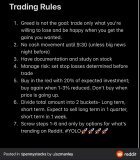

Regardless, unless you're buying blue chip stocks, I would over do it on research. Don't just take a tip without looking it up. Recommend against hype buying unless it's easy to predict like the vaccine plays late spring or when Canada legalized pot. Get in and get out on hype stocks.