C.R.E.A.M

Active member

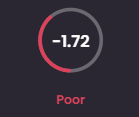

14606022:Casey said:Just bought another house. Might be the smartest or stupidest thing we’ve ever done kind of remains to be seen. Being over 30 means agonizing over interest rates, ugh

View attachment 1091408

As long as you can cash flow that bad boy in a down market you'll be good. You know the trends if this isn't your first. Not sure if we'll ever see a interest rate environment like we did the last 10 years tho. Hold onto that cheap money if you got it. Lucky!