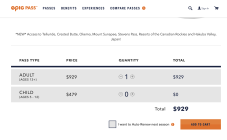

I didn't realize that signed up for auto renewal last year for Epic Pass / Vail Resorts for my wife and my passes. Vail charged $49 / pass down payment last March. I called Vail yesterday and was told, very rudely, That there's no way to cancel once the $49 down payment goes through. I lost my job this summer and can't afford to pay $1000 for 2 passes so I'm desperate to get out of this final $1000 payment because of auto renewal. I did not purchase pass insurance.

Options:

1. I called credit card company and they said I could dispute the charge once it comes through because I tried to cancel previously with Vail. But no guarantees I will win dispute of fine print when I purchased pass.

2. Cancel credit card so they can't charge me. However, not sure if they will pursue through collections?

Any help or advice on how others have handled this situation would be great!

UPDATE 11/9/18: I did not want to chance this going to collections and hurting my credit so I disputed the charge through my cc company, Discover. I WON the dispute for $1000 (two passes). I did not dispute the initial deposits of $50/pass. The final decision said Vail Resorts never responded.

If this happens to you, make an attempt to cancel the pass through vail resorts prior to the full charge. Document the call and include this in your dispute with the cc company once the charge goes though. Hopes this helps others in the future.

**This thread was edited on Nov 9th 2018 at 3:47:40pm

Options:

1. I called credit card company and they said I could dispute the charge once it comes through because I tried to cancel previously with Vail. But no guarantees I will win dispute of fine print when I purchased pass.

2. Cancel credit card so they can't charge me. However, not sure if they will pursue through collections?

Any help or advice on how others have handled this situation would be great!

UPDATE 11/9/18: I did not want to chance this going to collections and hurting my credit so I disputed the charge through my cc company, Discover. I WON the dispute for $1000 (two passes). I did not dispute the initial deposits of $50/pass. The final decision said Vail Resorts never responded.

If this happens to you, make an attempt to cancel the pass through vail resorts prior to the full charge. Document the call and include this in your dispute with the cc company once the charge goes though. Hopes this helps others in the future.

**This thread was edited on Nov 9th 2018 at 3:47:40pm